child tax credit september 2020

Thats an increase from the regular child tax credit of. Specifically the Child Tax Credit was revised in the following ways for 2021.

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have.

. If your AGI is 425000 youre in the. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021. Families that are eligible for the credit but have not received checks likely because they didnt file a 2019 or 2020 tax return can still.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. The IRS will use your 2020 or 2019 tax return whichever is filed later or information you previously entered using the non-filer tool to determine your eligibility for the.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Youll need to print and mail the completed Form 3911 from. Part of this credit can be refundable.

Typically you can expect to receive up to 300 per child under age of 6 250 per child ages 6 to 17. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Users will need a copy of their 2020 tax return or. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5 and. Thats an increase from the regular child tax credit of up to 2000 for each child up to age 17.

The credit amount was increased for 2021. If your adjusted gross income is 150000 in 2020 youre well below the phase-out threshold and youd be entitled to the full Child Tax Credit. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Your monthly child tax credit payment is also dependent on your income. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. The amount of credit actually increased for 2021 up to 3600 for children under 6 and up to.

Thats up to 7200 for twins This is on top of payments for any other qualified child. IR-2021-153 July 15 2021. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

The Child Tax Credit provides money to support American families. The IRS bases the monthly amount of the child tax credit on 2019 and 2020 tax. The American Rescue Plan increased the amount of the Child Tax.

While the IRS did extend the 2020 and 2021 tax filing dates due to. Users will need a copy of their 2020 tax return or. Check mailed to a foreign address.

At first glance the steps to request a payment trace can look daunting. The first phaseout can reduce the Child Tax Credit to 2000 per child. Some households will need to pay back their September child tax credit payments in 2022.

IRS Tax Tip 2020-28 March 2 2020. Here is some important information to understand about this years Child Tax Credit. If you opt out of advance payments you are choosing to receive your full Child Tax Credit 3600 per child under age 6 and 3000 per child age 6 to 17 when you file your 2021.

Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022 or it could have issued an overpayment. It could also be that you received advance Child Tax Credit payments last year.

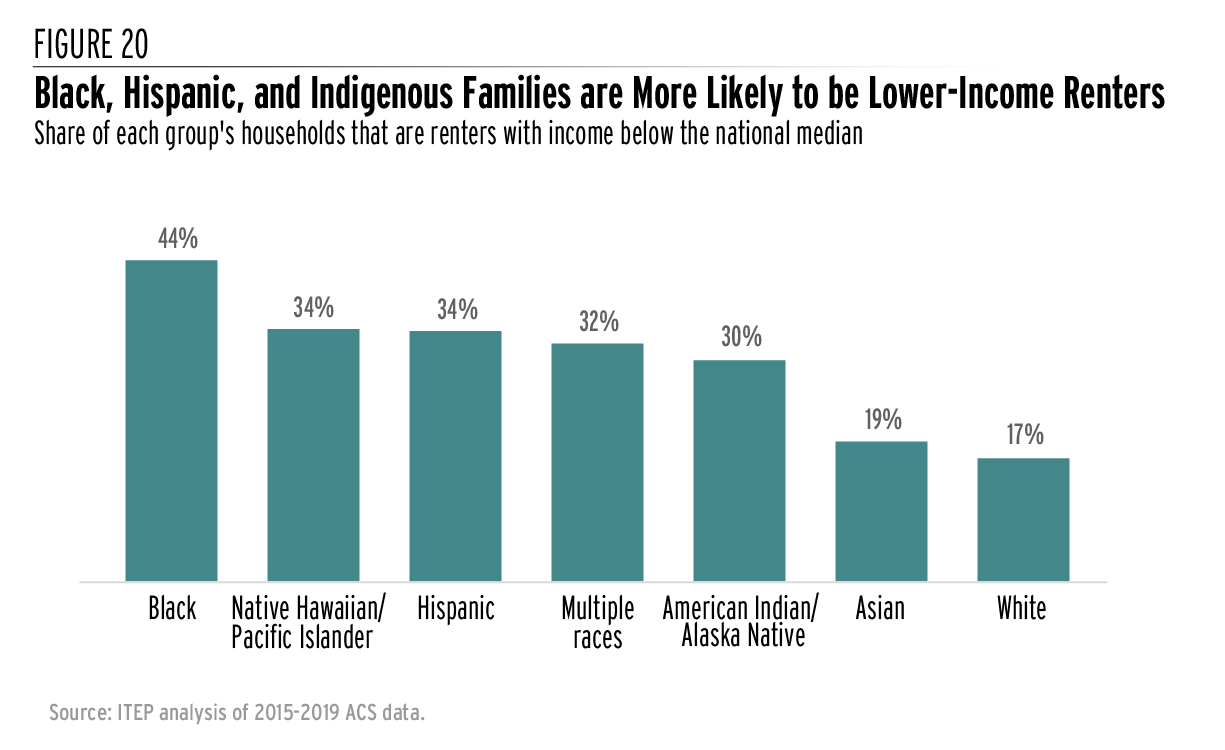

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

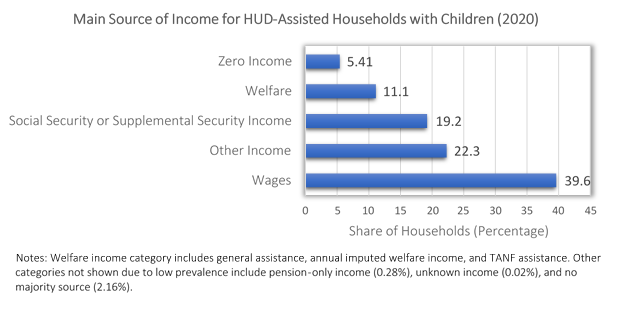

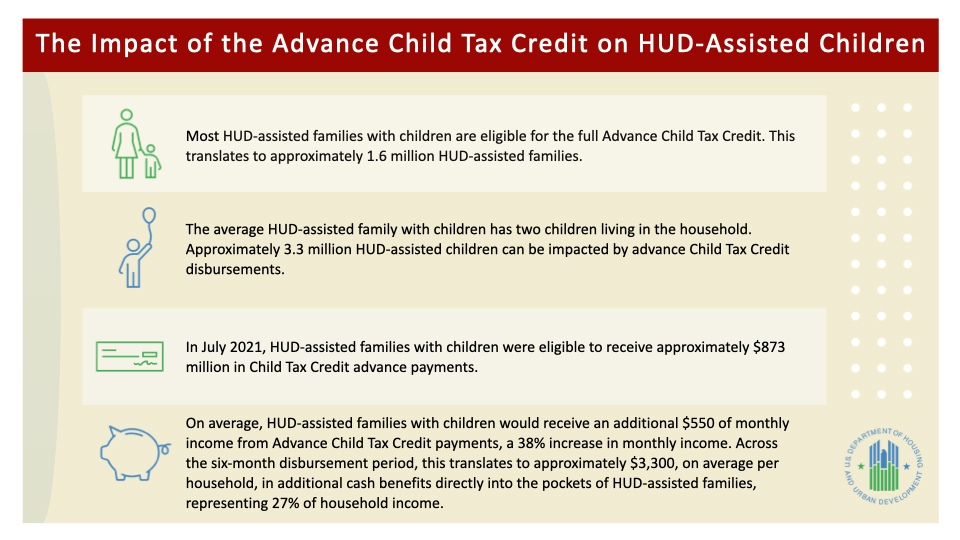

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

2020 Tax Expenditure Evaluation Reports Colorado General Assembly

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 8 Things You Need To Know District Capital

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Child Tax Credit 2021 8 Things You Need To Know District Capital

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Irs Issues Employer Guidance On Covid 19 Paid Leave Tax Credits Cupa Hr

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How Is The Tax Credit Reconciled Beyond The Basics

Adance Tax Payment Tax Payment Dating Chart

2020 Tax Expenditure Evaluation Reports Colorado General Assembly

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney