how much tax is taken out of my first paycheck

This all sounds good. If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

You pay 12 on the rest.

. While you may think that the answer is a simple figure figuring out how much taxes are taken out is not necessarily a process that takes a couple of seconds to complete. IR-2019-178 Get Ready for Taxes. For self-employed individuals they have to pay the full percentage themselves.

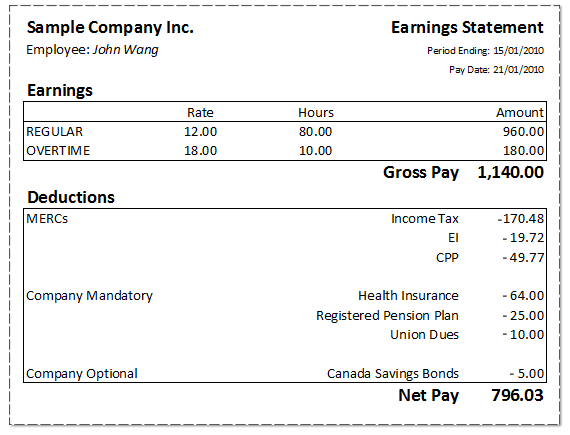

Taxed 25 on first paycheck of this year taxed 13 on last month of last years check which grossed same amount. Employer says tax is higher at beginning of year. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

I dont have any money currently going into a 401k. How Much Taxes Are Taken Out of My Paycheck. The average taxpayer gets a tax refund of about 2800 every year.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. For example for the 2012 tax year single filers paid a 10 percent federal income tax on the first 8700 of taxable income. Multiply the result by 100 to convert it to a percentage.

The tax wedge isnt necessarily the average percentage taken out of someones paycheck. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The next 30249 you earn--the amount from 9876 to 40125-. 7 Factors Influencing the Amount 1. This calculator is intended for use by US.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. If you had 50000 of taxable income youd pay 10. The calculation is based on the 2022 tax brackets and the new W-4 which in.

Calculate Your Paycheck in These Other States. Federal income tax 12-22 of gross your effective rate is dependent on how much is subject to 12 and 22. Amount taken out of an average biweekly.

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Amount taken out of an average biweekly paycheck. Employer tells me tax is higher at beginning of year and goes down as the year goes on.

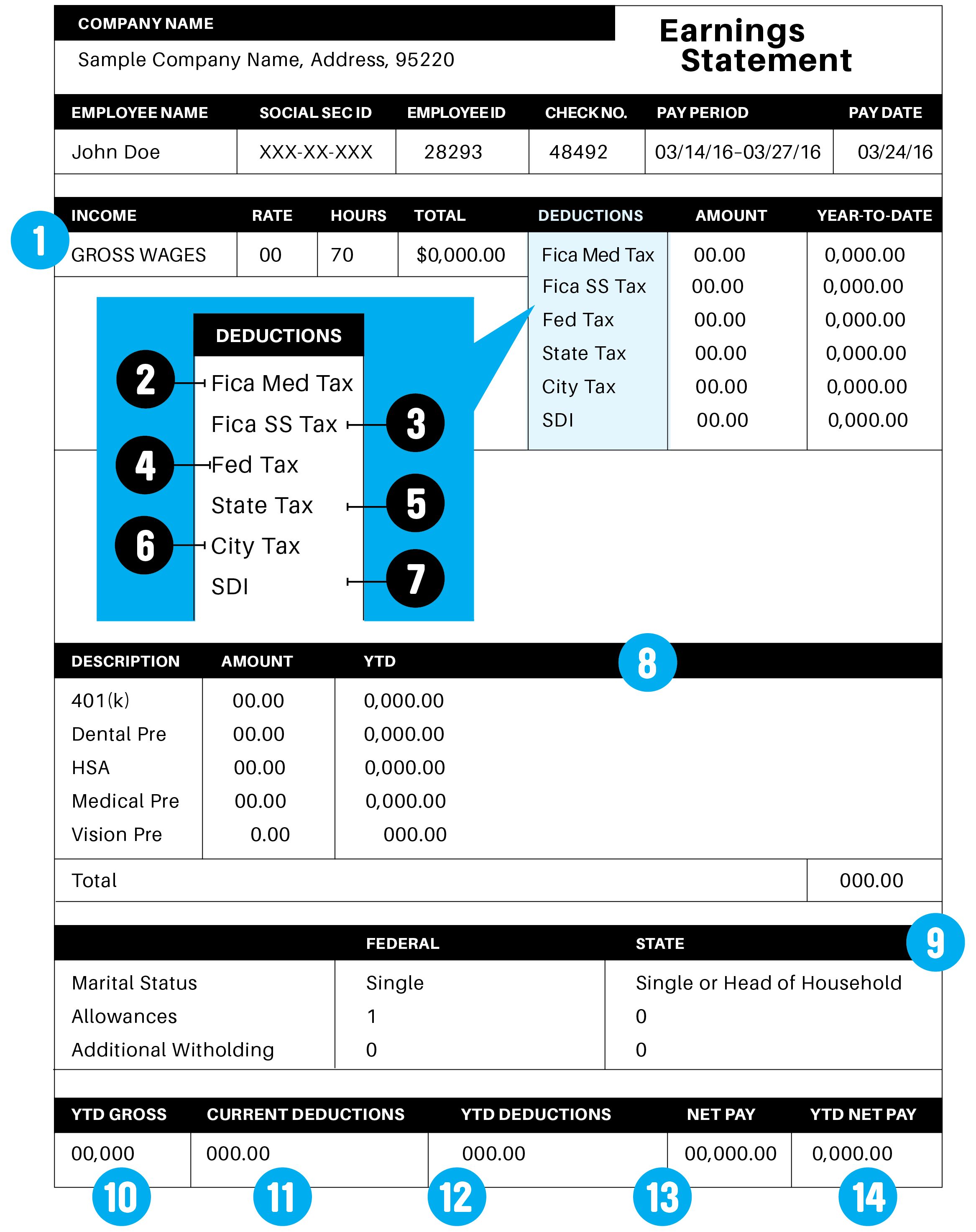

Total income taxes paid. This is because they have too much tax withheld from their paychecks. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Both employee and employer shares in paying these taxes each paying 765. They can either be taxed at your regular rate or at a flat rate of 22.

California income tax 4-8 of gross your effective rate is dependent on how much is subject to 4 6 and 8. Knowing your gross pay is important. If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental wages separately and tax them at that 22 rate.

Divide the total of your tax deductions by your total or gross pay. You didnt earn enough money for any tax to be withheld. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

This equates to 37 of my salary being taken out in taxes medicare FICA etc. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. If no federal income tax was withheld from your paycheck the reason might be quite simple.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. In fact a number of factors go into the amount of money that is taken out of your paycheck. How much will taxes take out of my paycheck.

According to some changes in the W-4 Employee Withholding Certificate find out more about that here earnings that are too low might not have their income taxes withheld at all. My first check was over 400 I worked 40 for one week and only 30 was taken out for state tax and other taxes. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

Depending on the state where the employee resides an additional amount may be withheld for state income tax. SDI 1 of gross up to 122909 gross. This means my salary of 60k a net salary of 38k.

The next bracket from 8701 to 35350 is taxed at a 15 percent tax rate. Actually you pay only 10 on the first 9950. Ask them for an explanation as to why this is.

We have a progressive income tax structure in the US. Its the number youll need to fill in on forms for rentals mortgages and more. Get ready today to.

Someone would have to pay just the right amount of taxes so that they wouldnt owe or get a refund when they file their tax returnin that case the average rate of 346 would apply. This comes out to 2307 biweekly before takes. I have a little bit of state tax taken out and some social security and whatnot but the last couple times have NO federal tax taken out.

In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000. That number is known as gross payso if youre paid 15 an hour and work for 20 hours a week your gross pay will be 300. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

Look at the tax brackets above to see the breakout Example 2. If you increase your contributions your paychecks will get smaller. Use tab to go to the next focusable element.

After all forms of taxes Im left with 1592 every 2 weeks. It can also be used to help fill steps 3 and 4 of a W-4 form. Or perhaps youre salaried and your gross pay is a flat number like 500 a week.

Federal income taxes are paid in tiers. For a single filer the first 9875 you earn is taxed at 10.

Different Types Of Payroll Deductions Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Confused About Payroll Deductions This Guide Walks You Through It In 2022 Payroll Deduction Wage Garnishment

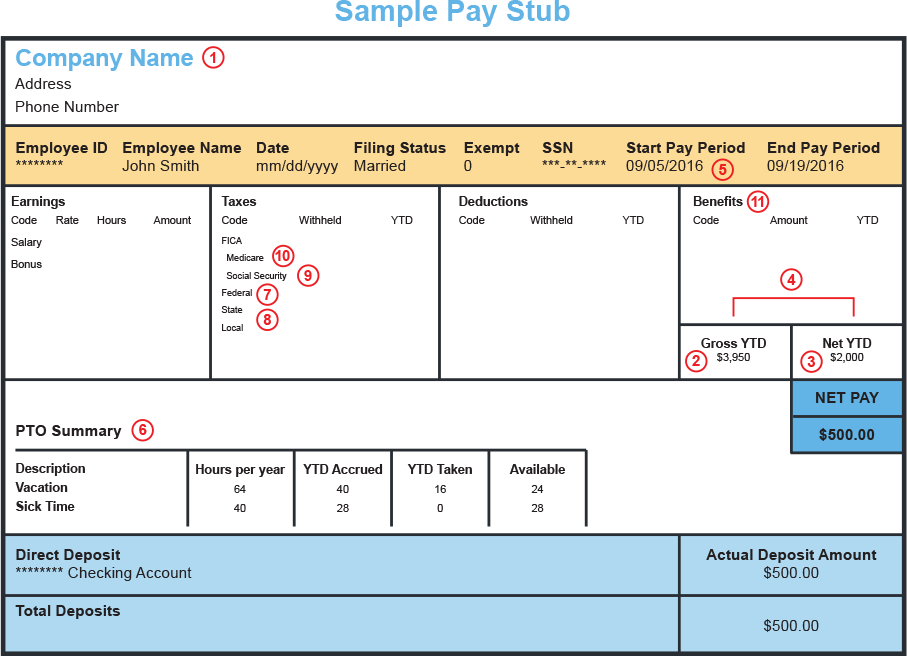

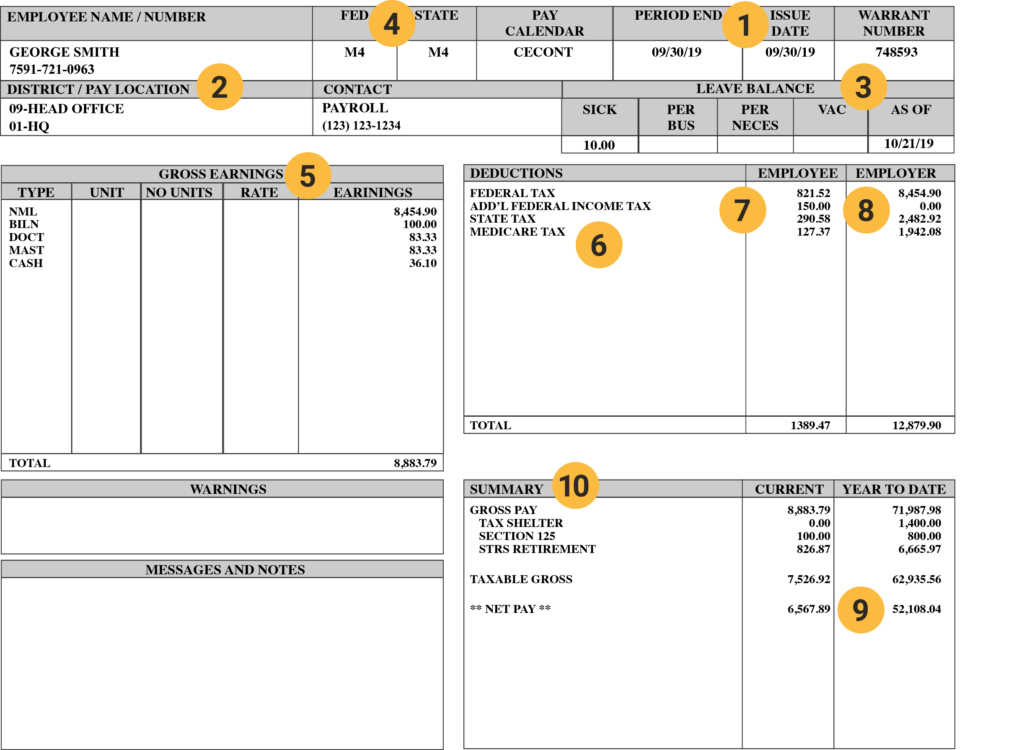

What Everything On Your Pay Stub Means Money

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Understanding Your Paycheck Credit Com

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Paycheck Calculator Take Home Pay Calculator

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Payroll Template

Understanding What S On Your Paycheck Xcelhr

Paycheck Taxes Federal State Local Withholding H R Block

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Themint Org Tips For Teens Decoding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp